How to Calculate Gross Profit Using Fifo Inventory Costing Method

First-in first-out FIFO last-in first-out LIFO weighted average AVG. Find the cost-to-retail percentage.

Fifo Vs Lifo Comparison Double Entry Bookkeeping

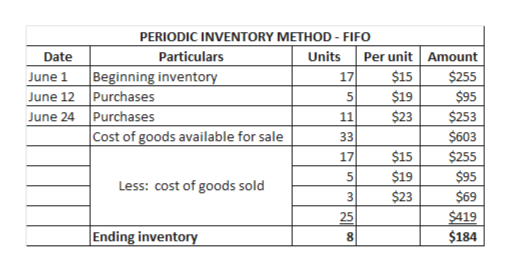

Remember that ending inventory is what is left at the end of the period.

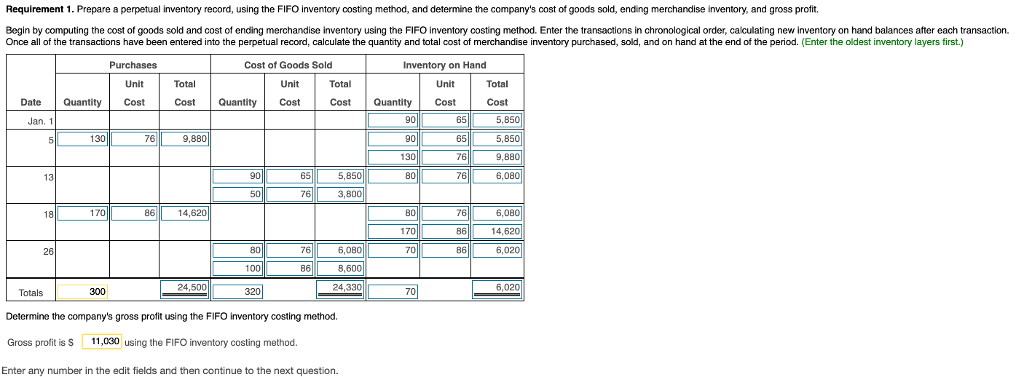

. The controller uses the information in the above table to calculate the cost of goods sold for the month of December as well as inventory balance as of the end of December. 300 500 06 or 60. Compute gross profit for August using FIFO LIFO and weighted-average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit 5200 FIFO 5500 LIFO 5260 Weighted-average Requirement 1.

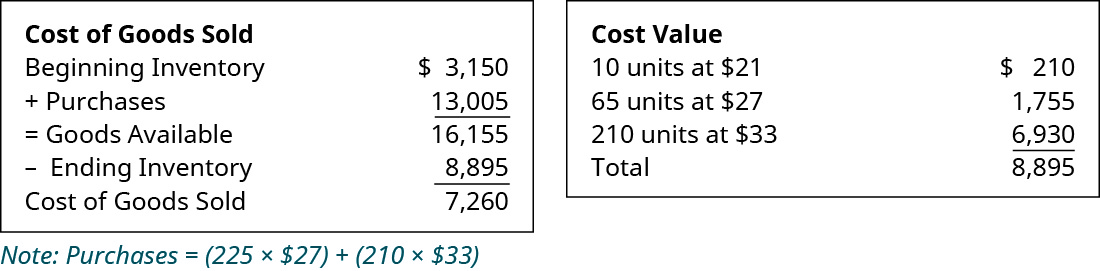

15000 - 6000 9000. Calculate the gross margin for the period for each of the following cost allocation methods using periodic inventory updating. Calculation of Gross Profit Perpetual For three months ending 31 March 2015.

How do you calculate gross profit FIFO. 7200 see last row of balance column ii. Calculate McLellands gross profit ratio rounded to two decimal places inventory turnover ratio rounded to three decimal places and the average days to sell inventory assume a 365-day year and round to two decimal places using the FIFO inventory.

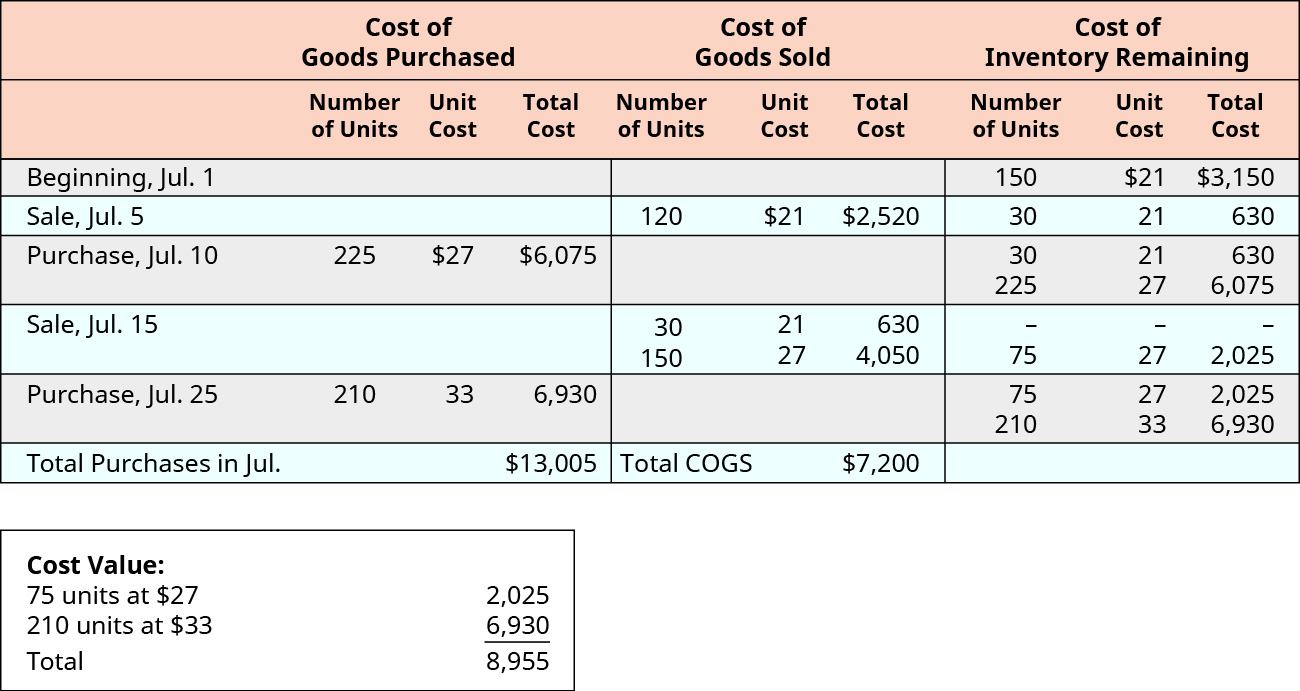

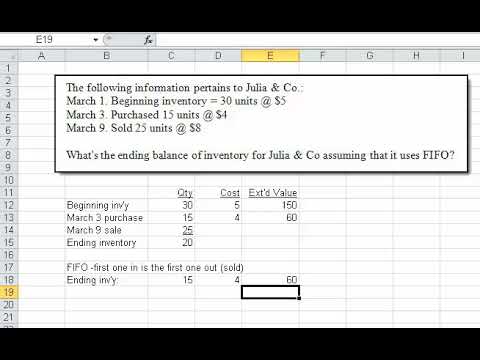

This also gives us the highest gross profit. Using this method you assume that the first item bought is the cost of the first. According to FIFO assumption first costs incurred are first costs expensed the cost of 16 units sold on 14 January would therefore be computed as follows.

Cost of 8 units from units purchased on January 7. November 11 2019. 100 units x 900 90000.

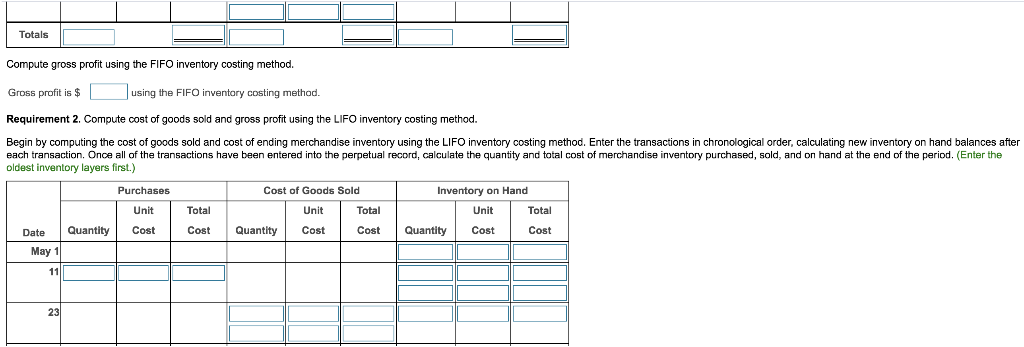

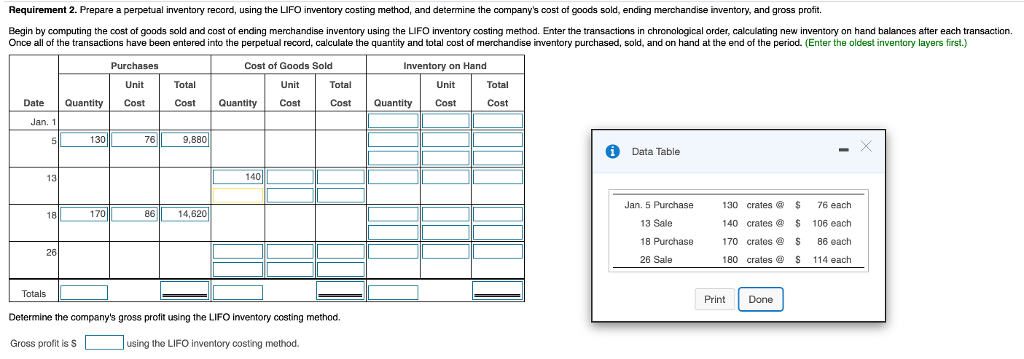

We need to prepare a perpetual inventory card using LIFO method to find ending inventory cost of goods sold and gross profit. For example John owns a hat store and orders all of his hats from the same vendor for 5 per unit. Ending inventory using gross profit Cost of goods available Cost of goods.

This method of calculating ending inventory is based on the assumption that the oldest items bought for the production of goods were sold first. Calculation of Gross Profit Periodic. Add together the cost of beginning inventory and the cost of purchases during the period to arrive at the cost of goods available for sale.

For example if a company purchases goods for 80 and sells them for 100 its gross profit is 20. 1000 Beginning inventory 2000 Purchased 1250 Ending inventory 1750 Units. Inventory 350.

However US companies are able to use FIFO or LIFO. Click to see full answer. Remember that as prices rise FIFO will give you the lowest cost of goods sold because the oldest and least expensive units are being sold first.

The gross profit method of estimating ending inventory assumes that the gross profit percentage or the gross margin ratio is known. Ending inventory using gross profit 9000. Unit of Goods sold.

Now to calculate ending inventory. The FIFO First-In First-Out method means that the cost of a. First-in first-out FIFO method.

Cost-to-retail percentage Cost of inventory Retail price of inventory. How to Use the Gross Profit Method. Inventory 700.

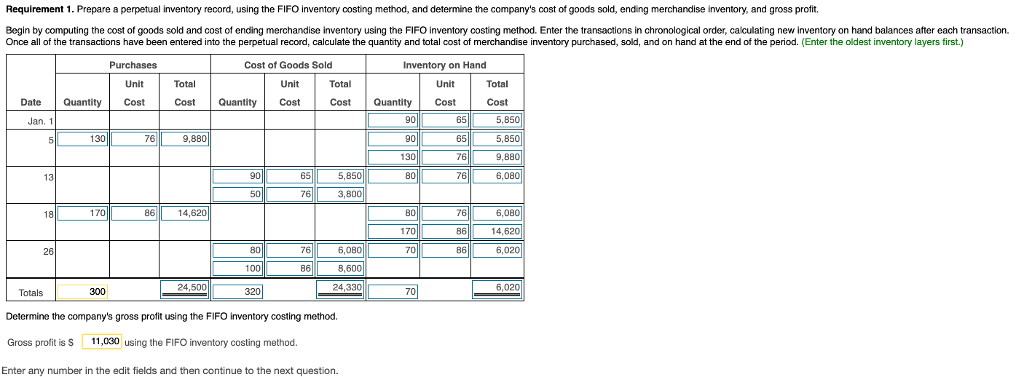

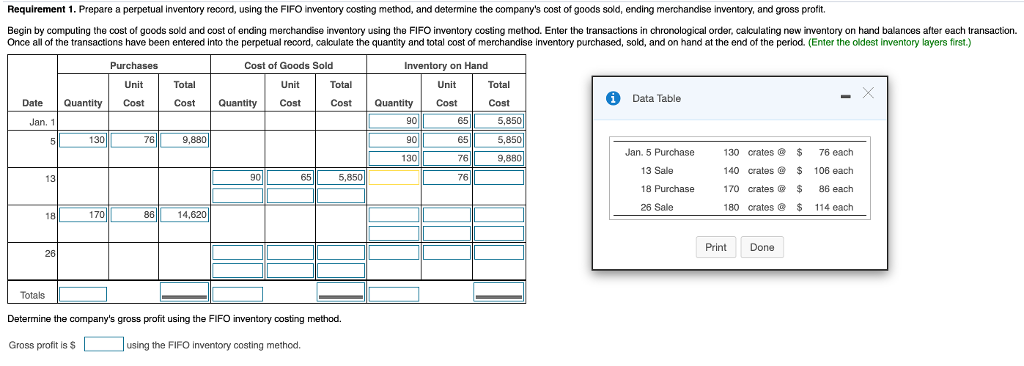

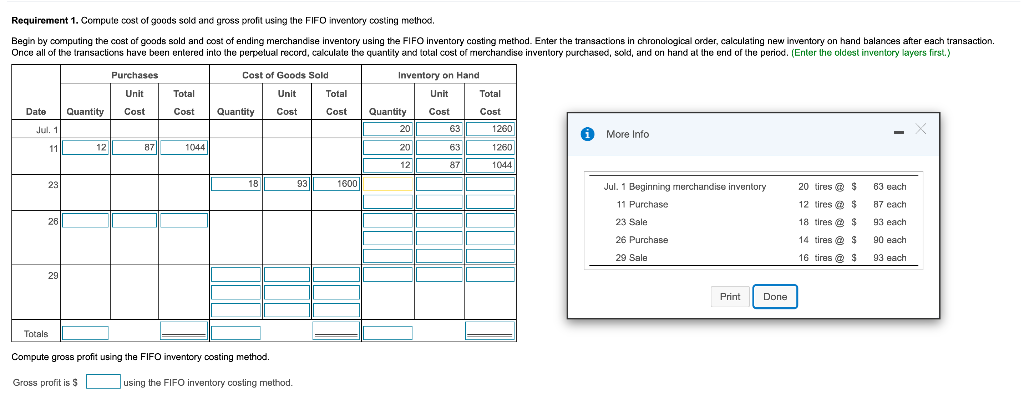

Multiply 1 - expected gross profit by sales during the period to arrive at the estimated cost of goods sold. Cost of goods sold is calculated by taking beginning stock adding all inventory purchases for the monetary interval in question after which subtracting the ending stock. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method Start by entering the beginning inventory balances.

Under LIFO our cost of goods sold is higher than it was under FIFO and our ending inventory is lower than under FIFO. Mikes cost of goods sold is 930000. 8 units 1020 8160.

Assume that all units were sold for 50 each. Follow these steps to estimate ending inventory using the gross profit method. Gross profit is lower under LIFO than FIFO which would result in lower income taxes because overall profit would be lower.

Gross profit under perpetual-lifo. For income tax purposes in Canada companies are not permitted to use LIFO. 300 units x 875 262500.

Cost of ending inventory under perpetual-lifo. The following are the most common methods used to determine ending inventory. Our gross profit is 292750.

Multiply 1 - expected gross profit by sales during the period to arrive at the estimated cost of goods sold. During inflation the FIFO methodology yields a higher value of the ending inventory lower price of goods bought and a better gross profit. Cost of 8 units from beginning inventory.

To calculate gross profit perpetual and gross profit periodic we take calculated inventories of FIFO from First in First out Method page and AVCO inventories from Weighted Average Cost Method page. To calculate FIFO First-In First Out determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold whereas to calculate LIFO Last-in First-Out determine the cost of your most recent inventory and multiply it by the amount of inventory sold. Cost of goods sold under perpetual-lifo.

2000 6000 3900 11900 total of sales column iii. Therefore we can see that the balances for COGS and inventory depend on the inventory valuation method. Add together the cost of beginning inventory and the cost of purchases during the period to arrive at the cost of goods available for sale.

Calculation of First In First Out method. Therefore when the company has sales of 50000 it is. Example of FIFO Method to Calculate Cost of Goods Sold.

Gross profit sales less cost of goods sold under LIFO is 286800. Include the following data. Also simply use the online simple fifo calculator that helps you in understanding how to calculate fifo ending inventory and provide you with a detailed table.

This results in a gross profit percentage or gross margin ratio of 20 of the selling price. The recent financial statements of McLelland Clothing Inc. 8 units 1000 8000.

Find the ending inventory.

First In First Out Inventory Fifo Inventory Accounting In Focus

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Solved Requirement 1 Compute Cost Of Goods Sold And Gross Chegg Com

Ending Inventory Costs Of Goods Sold Using Fifo And Lifo Exercise 6 12 Youtube

Calculate Ending Inventory Using The Fifo Method Youtube

First In First Out Inventory Fifo Inventory Accounting In Focus

Solved Requirement 1 Prepare A Perpetual Inventory Record Chegg Com

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Solved Requirement 1 Prepare A Perpetual Inventory Record Chegg Com

Solved Requirement 1 Prepare A Perpetual Inventory Record Chegg Com

Answered Compute Ending Merchandise Inventory Bartleby

Solved Requirement 1 Compute Cost Of Goods Sold And Gross Chegg Com

First In First Out Inventory Fifo Inventory Accounting In Focus

1a Ch 6 Gross Profit Fifo Youtube

Solved Compute The Cost Of Cost Of Goods Sold Cost Of Chegg Com

Inventory And Cost Of Goods Sold Fifo Youtube

Solved Requirement 1 Compute The Cost Of Goodssold Cost Of Ending Course Hero

First In First Out Inventory Fifo Inventory Accounting In Focus

Calculation Of Gross Profit Using Calculated Inventories Of Fifo And Avco Basic Concepts Of Financial Accounting For Cpa Exam

Comments

Post a Comment